Frequently Asked Questions

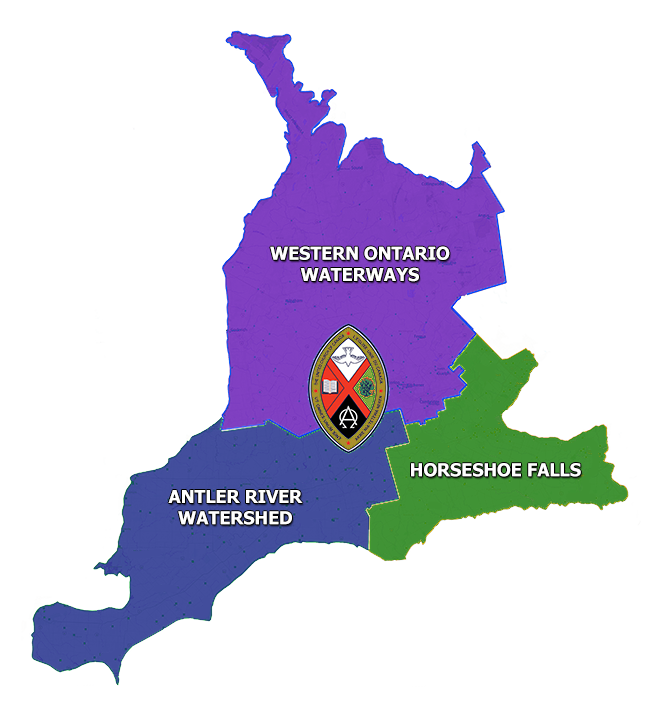

What happened to Presbyteries and why do we have Regional Councils now?

We moved from Presbyteries and Conferences to Regional Councils in 2019 following the passing of a category 3 remit. The goals of the structural change were to reduce the number of volunteers needed, to simplify and expediate decision making, to try to resource complex decisions with staff expertise and to cut costs across The United Church of Canada. Many of the decisions that were made at both the Presbytery and Conference level are now made at the Regional Council in the Executive, the Commissions and at Regional Council meetings in the fall and spring. Also, in less complex terms we no longer had the resources, human or financial, needed to continue in the presbytery structure.

Where do I find The Manual, Trustee’s Handbook, Financial Handbook and all of the other Handbooks and Guides?

What is the Underused Housing Tax?

The Underused Housing Tax (UHT) is a new 1% annual tax levied on the value of residential property owned by non-Canadians and some companies/trusts that is vacant or considered underused. The intention of this tax is to deter non-residents and some companies/trusts from passively investing in Canadian real estate and to make housing more available to Canadian residents. Because of the unique United Church Trust Model Deed and resulting trust structure for holding real property, our legal advice is that church manses are inadvertently caught up in this based on legal technicalities. Church trustees who hold title to a manse should file out of an abundance of caution. Each trustee impacted needs to file separately including their personal social insurance number.

Is this absolutely necessary?

The General Council Office working with Pacific Mountain Regional Council sought legal advice on this matter and submitted an appeal to the CRA. The appeal was declined. As goofy as this requirement is, filing is recommended to avoid potential liability for a $5,000 fine per year. Even though virtually no manse will have a tax liability. Unless something changes, filers should complete a separate form for both the 2022 and 2023 years.

Note: any incorporated ministries that own a house will typically be exempt because charity direct ownership is exempt. The argument that our congregations are charities holding title was dismissed.

Who needs to file?

All non-Canadian property owners and some companies/trusts are required to file a UHT form (UHT- 2900) with the Canada Revenue Agency (CRA) by April 30 annually. The tax itself will likely not apply to most -if any manses – if they are occupied(exemptions 510 or 520), however all non-Canadian property owners and some companies/trusts are required to file even if they will be exempt from paying the tax.

If a church manse title is held in the name of “the Trustees of XYZ United Church” which is considered best practice, filing is technically required. Even worse, each and every trustee should file.

Note: if title is held in the name of “The United Church of Canada” or in the name of the local church with no mention of trustees, then no filing is required because direct charity ownership is exempt. We are not making this up!

Tips for filing

To file a UHT tax form, you must have a valid CRA tax identifier number. Individual trustees should file a form and use their SIN as an identifier.

If any properties do not have a Canadian postal code, when filing the UHT form this should be left blank. Do not use the postal code of your local post office as this may negate your exemption.

Others have spoken to the Canadian Revenue Agency (CRA) and they see no issue with not having a postal code to input on the form (only road access properties will have a postal code).

Not having a postal code means that you will also be unable to access the: “Underused housing tax vacation property designation tool”, but it is not necessary to do so if you are exempt as above, and the tool is not helpful, in any event.

Filing Extension for 2022 and 2023

The minimum penalty for late filing is $5,000 per property for any individual owner. Although April 30, 2023 was the deadline to file your UHT form, the CRA has effectively extended the filing deadline for the Underused Housing Tax (UHT) to April 30, 2024, this year only, in an effort to provide more time for affected owners to comply. The CRA’s application of penalties and interest will be waived provided the returns for tax years 2022 and 2023 are filed by April 30, 2024.

Ottawa is Considering Exempting Canadians From Filing UHT for the 2024 Tax Year

In the latest twist, Ottawa is proposing to largely scrap filing requirements that would also affect many Canadian and permanent resident homeowners and some Canadian corporations. Unless something changes in the coming weeks, the most prudent thing to do would be to file a separate form for each of 2022 and 2023.

What is ChurchHub and how do I get there?

ChurchHub.ca (opens in a new tab) is part of a significant shift in the life of our church and how we live out our call to ministry and discipleship. It is both a policy that was passed by General Council to be “regularized as the required process for ministry personnel and communities of faith to search for calls and appointments” and the support structure for communication between the denomination, ministry personnel, communities of faith and members who participate in regional and denominational ministry.

I am having trouble with ChurchHub ... What should I do?

Submit your query to ChurchHub directly at this link:

How to Add, Edit, or Delete Officer Roles in ChurchHub

Watch this video:

If I want a temporary or permanent licence to marry, who do I contact?

The Governing Official for the regional council, Sue Duliban, Executive Assistant. SDuliban@United-Church.ca

Can I contact the Marriage Office directly to make changes to my contact information (address, name, phone, regional council for example)?

No you cannot. All clergy information changes/updates need to be completed and submitted to the

Marriage Office by the Governing Official for the regional council. Sue Duliban, Executive Assistant,

fulfills that role. SDuliban@United-Church.ca

What quick and easy tips can you give me for increasing donations and lowering our deficit?

None! Well, that’s not exactly true. We offer online courses, coaching and resources that will teach you stewardship best practices that are grounded in Christian theology as well as wisdom from the wider nonprofit sector. However, there is no magic, overnight fix I can offer that will immediately transform the financial situation at your community of faith. The changes we suggest take time and lots of practice to implement. It may take a while to see financial results. However, we do often see strengthened faith and relationships pretty quickly in the communities of faith that move to a wholistic, year-round approach to stewardship. Contact Brenna Baker for more information.

Can someone come to preach or lead a talk at our church about stewardship, legacy giving or Mission and Service?

On the one hand, I am always honoured to receive this request. I appreciate that it can be special to have someone come to the congregation and make that connection to the wider church while sharing some information that might be complex or challenging. I also know it used to be common practice to have a staff person do “the circuit” and offer a bunch of lunch and learns about legacy giving, for instance.

However, we’ve been learning in the last years that having a speaker offer an occasional Mission and Service talk, for example, is nowhere near as impactful as leaders from within the congregation learning about the amazing work of M&S and educating others from within. My message might generate some additional donations that day, but having someone from the congregation speak to their friends once a month about Mission and Service would increase generosity on a bigger level. We are also mindful of the best use of resources and equity in a national church. In the GTA, I could theoretically offer a talk to several United Church congregations in the same city and be home in a couple of hours. It’s a lot harder (and more expensive) for my colleagues covering a much bigger geography to do the same.

That’s not to say I will never meet with you! I will always be available to speak by Zoom to your leadership or stewardship committee. But we’re asking a few things of the communities of faith making the request for an in-person Sunday morning speaker. First, we invite you to participate in a Getting Started in Stewardship webinar offered throughout the year. This is our way of teaching you to fish, so to speak – giving you the tools to increase generosity in the whole life of the community. We’re also hoping that when we speak, other nearby United Church congregations are invited – to maximize our resources. Last, we wish to come on a Sunday (or other time) when the ministry personnel will be present, rather than being simply pulpit supply. This reiterates the idea that the community of faith is invested and the concepts of stewardship are important.

I can also offer tons of resources for you to lead a talk or worship service yourself. Again, we find this a lot more meaningful and impactful in the long run. The basics are here: https://united-church.ca/worship-theme/mission-and-service-worship but contact me for recorded messages and other tools you can use in worship.

Contact Brenna Baker for more information.

What is Mission and Service?

Looking for Mission and Service Stories (Minutes for Mission) – and add this link – Mission and Service Stories

What happened to Minutes for Mission?

Many of you will be familiar with the booklet, “Minutes for Mission” that congregations used to receive in order to promote Mission and Service. It contained brief stories – one for every week of the year – that could be photocopied into bulletins or read in worship in order to explain the impact of Mission and Service giving.

We still have amazing stories to share about Mission and Service, but the format has changed slightly. Now, all the stories are online: https://united-church.ca/community-and-faith/get-involved/mission-and-service/mission-and-service-stories They can still be used in print materials or read out in worship. There are also videos to include either in worship or for study groups to experience more deeply the difference your Mission and Service donations are making.

Contact Brenna Baker for more information.

What are some of the key accomplishments/tasks of the Discipleship & Justice Commission?

- Mission and Support Grants are received, reviewed and awarded by this Commission. Mission Support Grants are intended for ministries and communities of faith that are living out regional and General Council priorities. (could add those here)

- Supporting communities of faith, the region and the wider United Church of Canada with…

- Affirming work

- Right Relations work

- UCW

- Children and Youth Ministries, including Camping and Chaplaincies

Contact Thérèse Samuel , Kathy Douglas or John Egger for more information.

What are the key priorities of the Discipleship & Justice Commission?

- Right Relations

- Camps/Youth/Faith Formation

- Chaplaincy

Contact Thérèse Samuel , Kathy Douglas or John Egger for more information.

What are the names of the UCC Camps or Retreats within our region?

Contact Kathy Douglas for more information.

Can the Discipleship & Justice Commission support (promote and offer financial help) to projects, programs and/or initiatives with a communities of faith, group or individual?

Yes, we have a budget that gets used to support honorariums, meeting expenses and resources. The commission would be pleased to know about and promote faith formation/ justice projects and initiatives within the region.

Do you need to be an official regional representative from a community of faith to be a Commissioner on the Discipleship & Justice Commission?

NO, anyone who is a member of the UCC (clergy or lay) and wishes to share their gifts, skills and passions can fill out an expression of interest You are needed!

Call Us

1-833-236-0280

Horseshoe Falls Regional Council

Supports, Connects, Empowers Communities of Faith